Thats a difference of RM1055 in taxes. As highlighted in earlier alerts a number of tax and non-tax measures have been announced as Malaysias response to the COVID-19 pandemic including the following.

Introducing The Payment Element

Melayu Malay 简体中文 Chinese Simplified Estimate of Tax Payable in Malaysia.

. The company can submit their request to IRBM Collection Unit in writing before the due date for payment. By far online payment is the easiest and most efficient way to pay income tax in Malaysia. In relation to this the Inland Revenue Board IRB has issued the Frequently Asked Questions FAQ - Deferment of Payment of Estimated Tax.

All businesses are allowed to revise their income tax estimates in the 11 th month of the basis period before 31 October 2022 and. Ouch This is how much your Property Stamp Duty or MOT Stamp Duty would cost you for a RM700000 property. However even if the request is accepted late payment penalty will still be imposed.

FAQs on the revision of estimate of tax payable in the 11 th month of the basis period and the deferment of CP204 and CP500 payments. Taxation System in Malaysia 马来西亚的税收制度 11 Tax rate 税率 12 Payment of tax 纳税 Malaysia adopts the self-assessment system for all taxpayers and the assessment of income tax is based on a current year basis. Further this is the first budget under the administration of.

On October 29 2021 Malaysia unveiled a variety of tax measures in its new budget that will impact businesses and individuals in 2022. Installment Payment CP204 For existing companies the estimated tax payable has to be paid in equal monthly installments beginning from the second month of the basis period for a year of assessment. 1 Payment via Telegraphic Transfer TTTransfer Interbank Giro IBGElectronic Fund Transfer EFT Tax payment using this method can be made to the Inland Revenue Board of Malaysia IRBM banks account.

The Malaysian Inland Revenue Boardfollowing announcements in the 2022 budgetissued the following guidance for small and medium-sized enterprises SMEs. Under the PEMERKASA Stimulus Package announced by the Government on 17th March 2021 it was proposed that deferment of tax instalments be granted to companies in the tourism and selected industries eg. This page is also available in.

This is the largest ever state budget worth some 3332 billion ringgit US802 billion as the government aims to boost post-pandemic growth. Real Property Gain Tax Payment RPGT 5. This would enable you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay from RM1640 to RM585.

Keep updated on key thought leadership at PwC. Tax Leader PwC Malaysia 60 3 2173 1469. 3 on next RM100000 RM3000.

2514 Ipoh Office. If you are not a tax resident you would not enjoy income tax reliefs. Each installment payment must be accompanied by a Remittance Slip CP501.

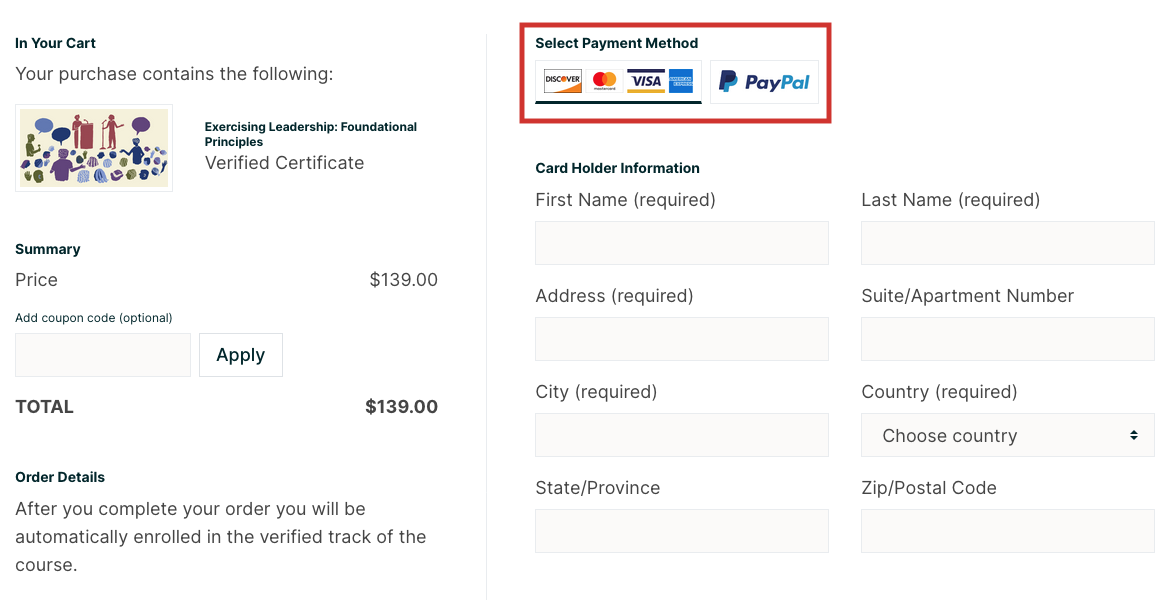

If company unable to pay their balance of tax by the due date the company can apply to pay the balance by instalments. IRBs FAQs on revision of estimate of tax payable and deferment of tax instalment payments arising from COVID-19 measures. Income tax payment can be made by credit card Issued by Malaysia bank in Malaysia.

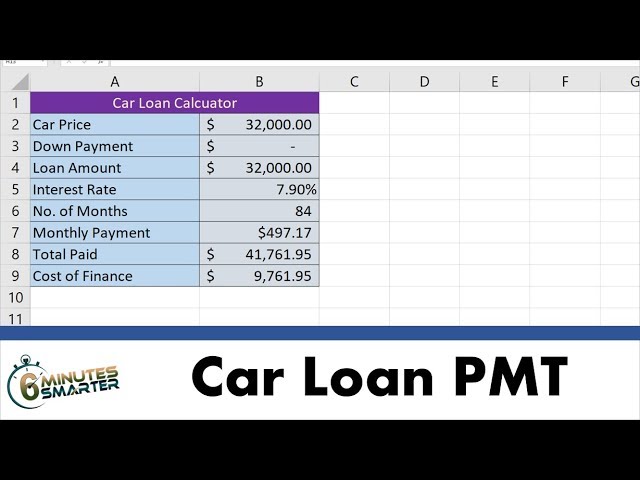

Total months in the basis period. Guidance FAQs on estimated tax payments for all businesses deferred tax instalments for SMEs. An increase of 10 on that installment payment will be imposed upon failure to pay the tax installment within 30 days of the stated date.

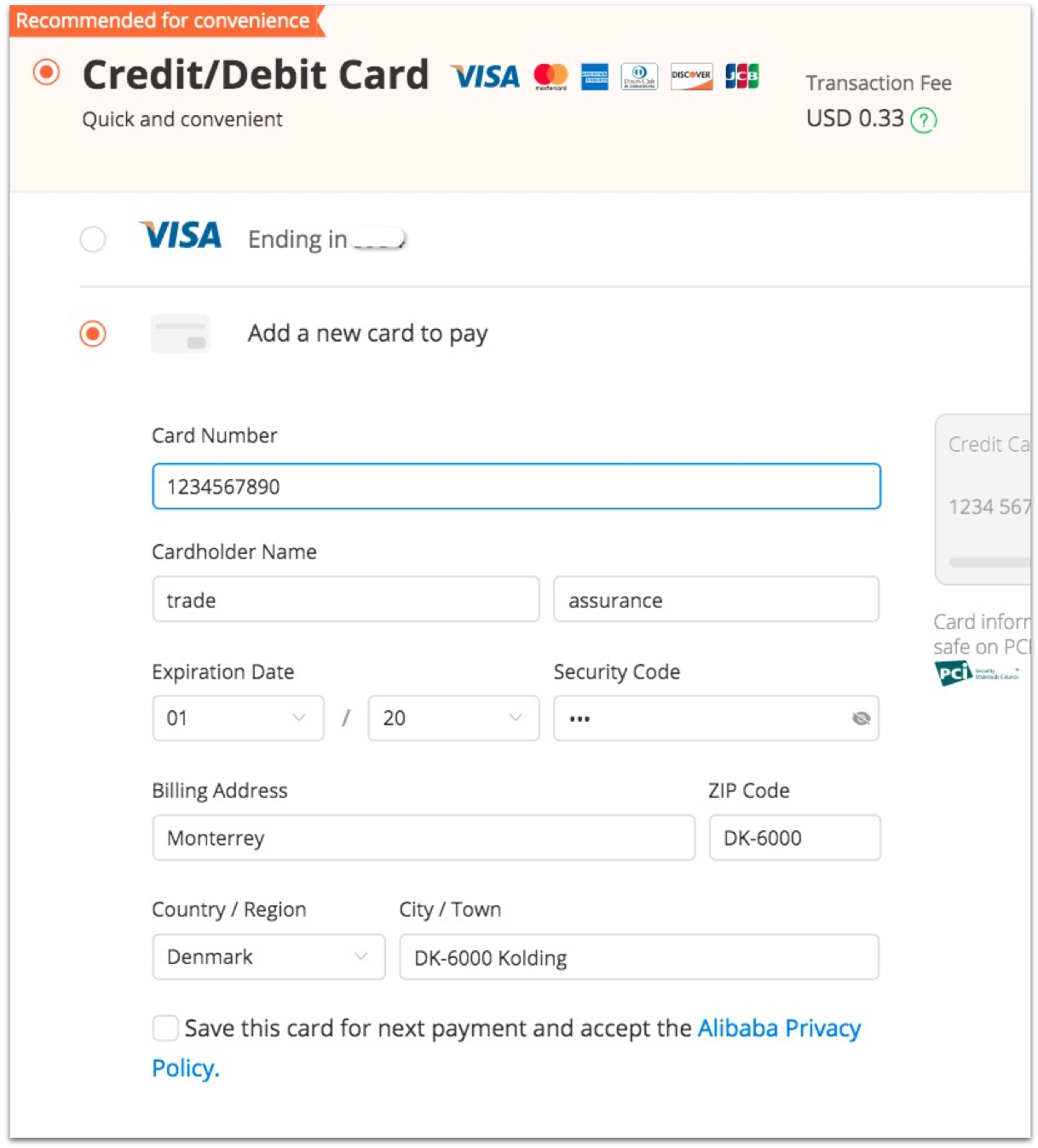

Microenterprises and small and medium enterprises MSMEs are allowed to defer. 2188 Kota Kinabalu Office. These services can be used for all creditdebit cards VISA Mastercard and American Express issued in Malaysia.

Frequently asked questions FAQs concerning the. Hence the amount of total income earned would be your chargeable income which would be used to compute your final income tax payment at a flat rate of 28. This service enables tax payment through FPX gateway.

User is required an internet banking account with the FPX associate. Most people receive their refund in an average of 10-14 days. Crystal Chuah Yoke Chin Tax Manager.

Jacks Income Tax Payments RM 100000 x 28 RM 28000. So that makes a grand total of RM14000. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to RM34500.

The IRBs media release and FAQs provide relief by permitting businesses an additional opportunity to revise their tax estimate in the 11th month of the. However credit card charges of 080 will be imposed on your income tax payment. The due date for each payment is the 1st day of the relevant month.

With effect from YA 2008 where a SME first commences operations in a year of assessment the SME is not required to furnish an estimate of tax payable or make instalment payments for a period of two years beginning from the year of assessment. Featured PwC Malaysia publications. The best would be via the IRBs own online platform ByrHASILIts the only online platform that supports payment by credit cards Visa Mastercard and American Express so you can earn some points or cashback for paying income tax just note that there is a processing.

Details of the account are as. Tax Payment via Credit Card through ByrHASIL portal will only be available from 1200 am until 1059 pm daily. Income Tax Payment excluding instalment scheme 7.

2 on next RM500000 RM10000. Advance corporate tax estimated tax generally is payable in monthly installments in Malaysia and an underestimation of the tax payable may result in penalties under certain circumstances. Your income tax payment can be made with Ezypay of 6 months 125 interest or 12 months 205 interest if your income tax amount is between RM1000 to RM500000 and you are.

Companies are required to pay tax by monthly instalments based on the estimates submitted commencing from the second month of the companys basis period. Monthly Tax Deduction MTD 6. Approximately 90 of taxpayers will receive their refunds in less than 21 days from the day their tax return was accepted by the IRS.

1 on first RM100000 RM1000. You bank will usually make your payment available within 1-3 days of receiving the payment from the IRS.

How To Write Invoice Payment Terms Conditions Best Practices

Use The Pmt Function To Calculate Car Loan Payments And Cost Of Financing Youtube

Meet Aspiration Zero The Credit Card That Rewards You For Going Carbon Neutral Fight Climate Change With Every Credit Card Swipe Go Aspire Cards Credit Card

Taxplanning Tax Measures Announced During The Mco The Edge Markets

Maulid Dan Daurah 40 Malam Sandakan Malaysia 2015 2016 Malam

Hab Dlt Payment Plan Request Berkheimer

2020 E Commerce Payments Trends Report Malaysia Country Insights

Global Payments 2021 All In For Growth Bcg

Advance Payment Invoice Template 9 Free Docs Xlsx Pdf Invoice Template Microsoft Word Invoice Template Invoice Format

Eft Nedir Nasil Yapilir Blog Seyahat Para

Free Payment Agreement Template Pdf Word Eforms

An Introduction To Buy Now Pay Later Payment Methods

Refinancing Flyer Template Instagram Real Estate Flyers Support Services Appraisal

Sisense Bi Online Training Rpa Devops Workday Hyperion Oracle Apps Training In 2022 Online Training Interview Questions Learning Environments